Kenya seeks Sh258 billion funding for JKIA expansion after cancelling Adani deal

In November 2024, President William Ruto called off the proposed public-private partnership with Adani, which would have allowed the company to add a second runway and upgrade the passenger terminal at JKIA in exchange for a 30-year lease.

Nine months after Kenya cancelled a controversial deal with India’s Adani Group, the government is now seeking funding from international lenders to finance a $2 billion (Sh258.4 billion) expansion of Jomo Kenyatta International Airport (JKIA).

In November 2024, President William Ruto called off the proposed public-private partnership with Adani, which would have allowed the company to add a second runway and upgrade the passenger terminal at JKIA in exchange for a 30-year lease.

More To Read

- KAA warns passengers of delays to JKIA, Wilson Airport as CHAN kicks off in Nairobi

- Suspected drug trafficker nabbed in South C hotel after abandoning 41kg of bhang at JKIA

- KAA calls for public input on airport plans months after collapse of controversial Adani deal

- KAA urges early travel as Nairobi Marathon shuts down key routes

- JKIA gets Africa’s first rapid aircraft recovery equipment worth Sh177 million

- Raila calls for unity, blames politics for collapse of Adani deal to expand JKIA

The decision came amid public outcry following the indictment of the group’s founder, Gautam Adani, by US authorities on fraud and conspiracy charges.

According to US prosecutors, Gautam Adani, his nephew and group executive director Sagar Adani, and Adani Green Managing Director Vneet S. Jaain allegedly engaged in a scheme involving bribery to secure Indian power contracts while misleading American investors during fundraising efforts.

However, Gautam Adani and the company have consistently denied the US allegations, calling them baseless.

"Less than two weeks back, we faced a set of allegations from the US about compliance practices at Adani Green Energy. This is not the first time we have faced such challenges," Gautam said during a speech at an awards ceremony last year, following the US indictment.

"What I can tell you is that every attack makes us stronger and every obstacle becomes a stepping stone for a more resilient Adani Group," he added in December.

Development lenders

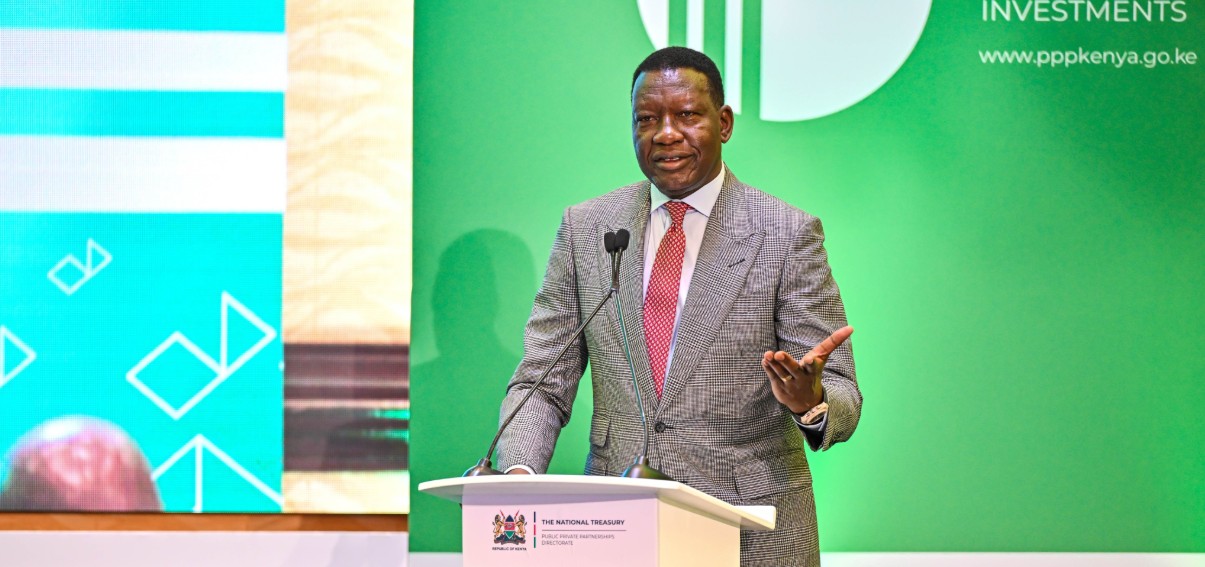

In light of this, Transport Cabinet Secretary Davis Chirchir confirmed on Monday that Kenya has formally invited development lenders—including JICA, China Exim, KfW, the European Investment Bank, and the African Development Bank—to support the airport upgrade.

"Instead of bringing concessioning to build the airport, we build the airport that we can concession later," Chirchir explained to Reuters, highlighting how this plan differs from the scrapped Adani deal, which would have involved the company expanding and operating the facility for 30 years.

Chirchir also revealed that the government plans to issue a securitised bond worth Sh175 billion (approximately $1.36 billion), backed by fuel levies and divided into domestic and international tranches, to finance road construction projects.

According to Chirchir, the foreign market for the bond issuance has not yet been determined.

Top Stories Today