Over 71,000 HELB defaulters blacklisted as Sh35 billion debt threatens student loans

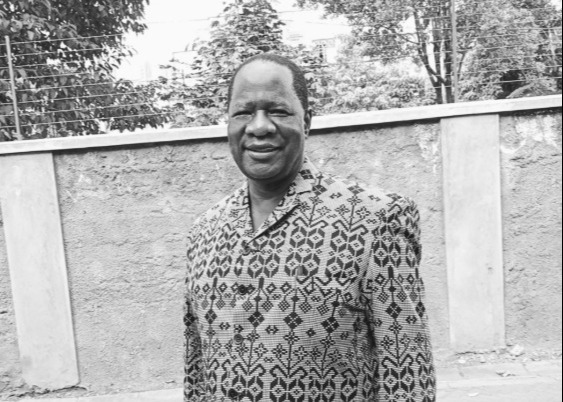

Helb CEO Geoffrey Monari warned that the Sh35 billion in defaults could have been enough to fund at least 289,000 university and college students for a full academic year.

More than 71,000 student loan defaulters have been blacklisted by credit reference bureaus after failing to repay loans from the Higher Education Loans Board (HELB), which is now grappling with a ballooning default amount of Sh35.14 billion.

The number of affected borrowers is part of a wider group of 310,942 former students who have defaulted on their loans, threatening the sustainability of the revolving fund meant to support university and college education.

More To Read

- HELB extends student loan application deadline

- Government disburses Sh23.16 billion to university, TVET students

- Universities directed to update student portals amid frustration over HELB delays

- HELB disburses Sh9.46 billion to over 309,000 university students, easing fee confusion

- First-year university students face chaos over upfront payments after fee reductions

- HELB loans awarded to 136,000 first-time university students as government caps fees

HELB chief executive Geoffrey Monari, according to the Daily Nation, revealed that 71,806 defaulters are now negatively listed with credit firms Metropol and TransUnion, cutting them off from access to essential financial services.

At the same time, 412,194 individuals who are actively servicing their loans have been positively listed for performing accounts.

Monari warned that the Sh35 billion in defaults could have been enough to fund at least 289,000 university and college students for a full academic year.

“If all debtors paid their dues, HELB would reduce reliance on the National Treasury funding. It would expand access to higher education, and institutional credibility would be strengthened,” he said.

HELB loans are offered to support students with tuition and upkeep and are repayable after graduation with an interest rate of four per cent.

However, the board has faced an uphill battle collecting repayments due to a growing perception among loanees that the funds are social welfare and not loans.

Monari pointed out that unemployment, migration of graduates, and short-term employment patterns have further complicated repayment efforts.

“HELB uses a multi-pronged approach to debt collection. This includes a statutory employer check-off system and strategic partnerships and data-sharing with institutions,” Monari explained.

Other recovery methods include periodic reminders, penalty waivers for lump sum payments, and engaging loan guarantors to encourage repayment.

As of now, HELB is managing a total outstanding balance of Sh101.4 billion across 774,092 loan accounts. Of this, 463,150 individuals are actively servicing loans worth Sh66.26 billion on a monthly basis.

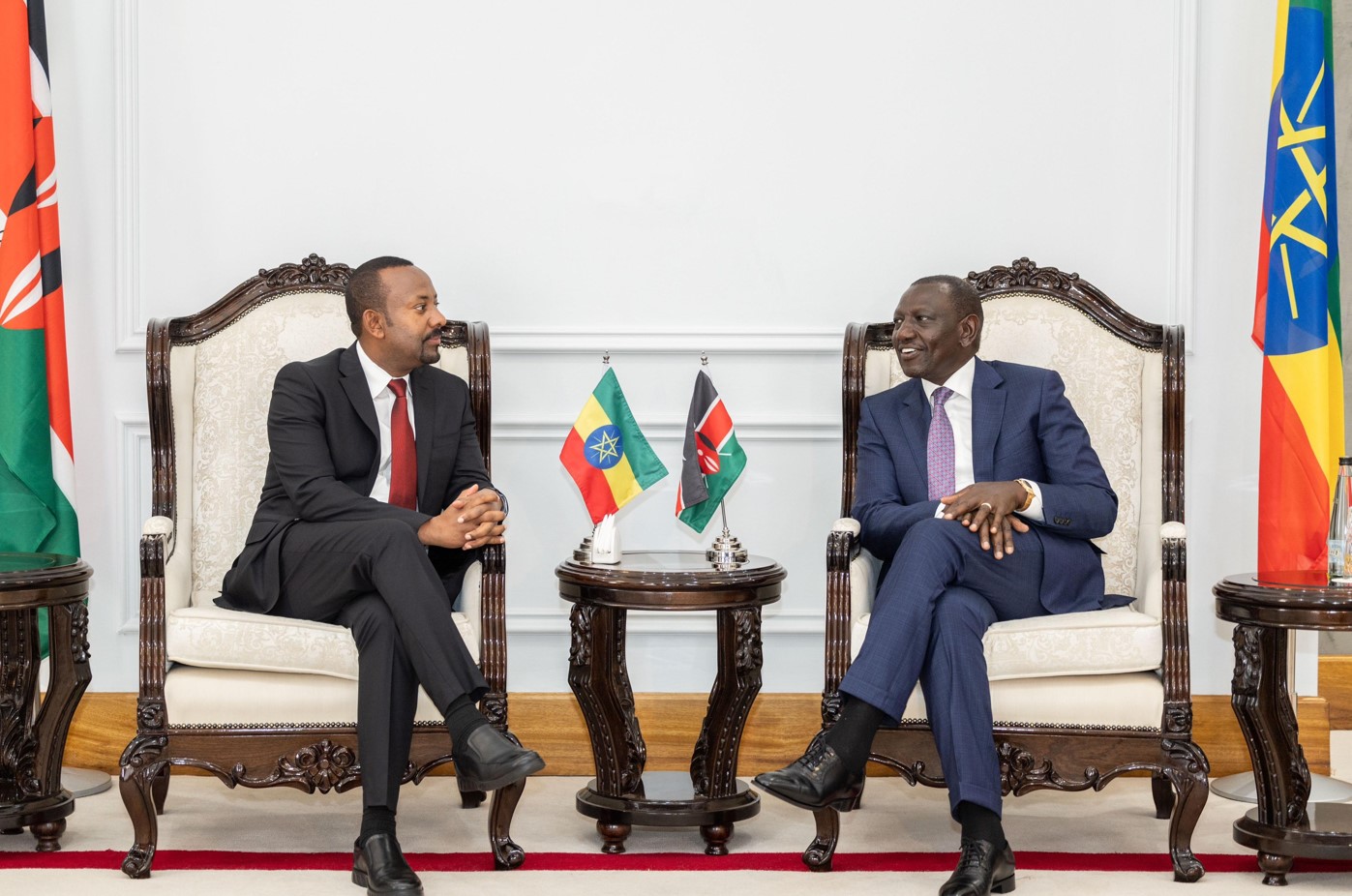

Despite earlier promises by President William Ruto to restructure HELB and offer interest-free loans, this pledge made during the 2022 campaign has yet to be implemented. Meanwhile, Monari ruled out any loan write-offs, saying such a move is not within HELB’s mandate.

“The decision to write off loans lies with the National Treasury through the Ministry of Education, not HELB,” he said.

Adding to the burden is Sh682 million owed by 11,117 students whose education was funded before HELB was established in 1995, raising questions about long-term enforcement and accountability of public loan systems.

Top Stories Today