Report proposes public-private partnership trust fund to tap pension, insurance capital to fund projects

The PPP-ITF proposal focuses on pooling long-term domestic capital from institutional investors such as pension funds and insurance companies. This fund would finance both the construction and operational phases of PPP projects, offering investors predictable returns while minimising the need for sovereign guarantees.

A major proposal in a report presented to the National Treasury recommends creating a Public-Private Partnership Implementation Trust Fund (PPP-ITF), which would raise capital from pension and insurance funds for infrastructure development.

The fund is intended to reduce reliance on government guarantees while offering steady returns to investors.

More To Read

- Contractors await Treasury’s verdict as review on Sh518.7bn pending bills nears completion

- Political Parties office gets Sh213 million boost in pre-election budget

- Petition exposes Sh975 billion debt linked to Treasury’s budget law breach

- Housing levy collections set to jump by 46% as govt eyes Sh95.8 billion

- Treasury revives plan to grant KRA real-time access to personal data in push for more tax

- Counties get Sh15.1bn relief from Treasury amid mounting arrears, service disruptions

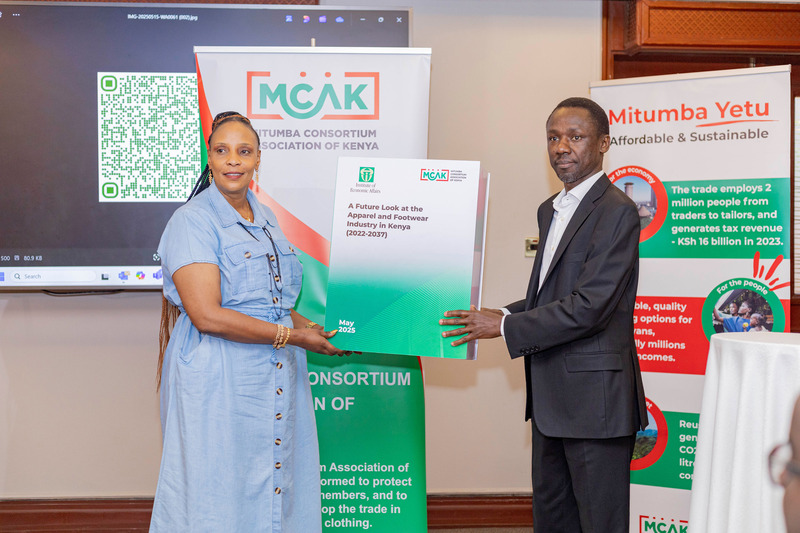

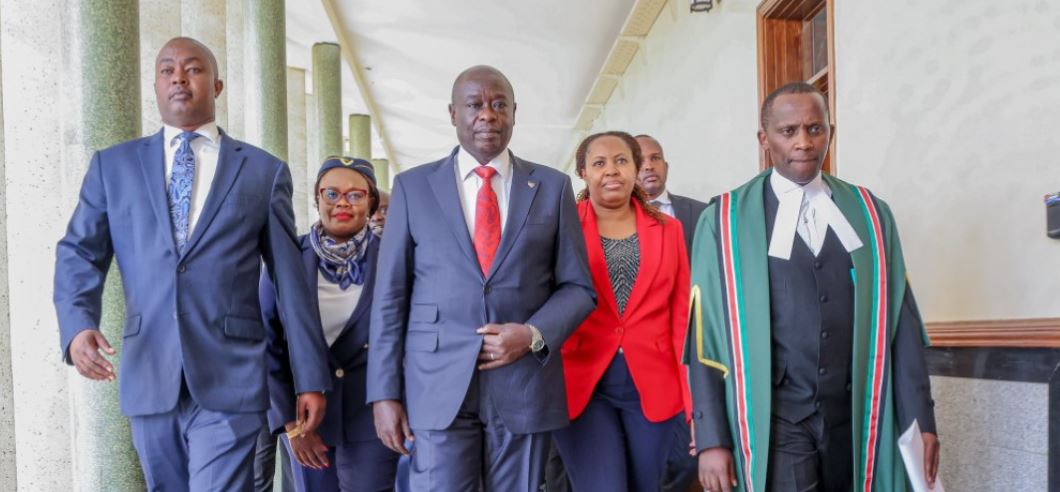

The final report by the Committee of Experts on Mobilising Domestic Capital for Public-Private Partnerships (PPPs) was officially presented to the National Treasury on Friday during a handover ceremony at the Serena Hotel in Nairobi.

According to the National Treasury, the report marks a significant milestone in Kenya’s efforts to bolster infrastructure development through PPPs.

The Committee of Experts, formed earlier this year, has outlined a strategic plan to unlock long-term capital from domestic financial markets to fund key infrastructure projects across the country.

National Treasury Principal Secretary Chris Kiptoo emphasised that while Kenya has successfully mobilised Sh140.7 billion in private capital through PPPs since 2013, much more can be achieved by tapping into the potential of local capital markets.

“The report provides a clear roadmap to harness the immense potential within our local financial ecosystem,” Dr. Kiptoo said.

“As the National Treasury and Government, we’re giving ourselves one month to review the report and provide a clear pathway for its implementation”, he added.

The PPP-ITF proposal focuses on pooling long-term domestic capital from institutional investors such as pension funds and insurance companies. This fund would finance both the construction and operational phases of PPP projects, offering investors predictable returns while minimising the need for sovereign guarantees.

According to Dr. Hosea Kili, Chairman of the Committee of Experts, the creation of the PPP-ITF represents a transformative shift in how Kenya finances its development.

"The PPP-ITF represents a paradigm shift in how we finance our nation's development. By creating a structured mechanism that aligns the interests of institutional investors with national development priorities, we can build sustainable infrastructure while generating consistent returns for Kenyan savers and pensioners," noted Dr. Kili.

Eng. Kefa Seda, Director General of PPP at the National Treasury, added that the trust fund would also leverage public sector financing to match private investments, ensuring the viability and sustainability of the projects.

He highlighted that the implementation of this initiative would require both legislative amendments and administrative actions.

"All other recommendations in this comprehensive report are designed to support, operationalise, and enhance the effective implementation of the Trust Fund. The PPP-ITF will leverage financing from the public sector, either from the national government or contracting authorities, to match private sector funding, thereby enhancing the viability and sustainability of infrastructure investments," he noted.

“We are aware that aspects of the report will require legislative amendments, while specific sections will easily be implemented through administrative actions. Let me assure you that the Directorate fully supports the initiative and will put in all efforts to implement the agreed recommendations”.

Top Stories Today