Pressure mounts on finance executives to operationalise County Assembly Funds

The law requires each county to set up a County Assembly Fund, managed by the clerk, to receive and retain all assembly monies. Any withdrawals must be approved by the Controller of Budget and authorised in writing by the administrator.

County finance executives have been directed to fast-track the creation of County Assembly Funds as pressure mounts over delays that have blocked ward representatives from accessing their budgets, more than a month after a new law granting financial autonomy took effect.

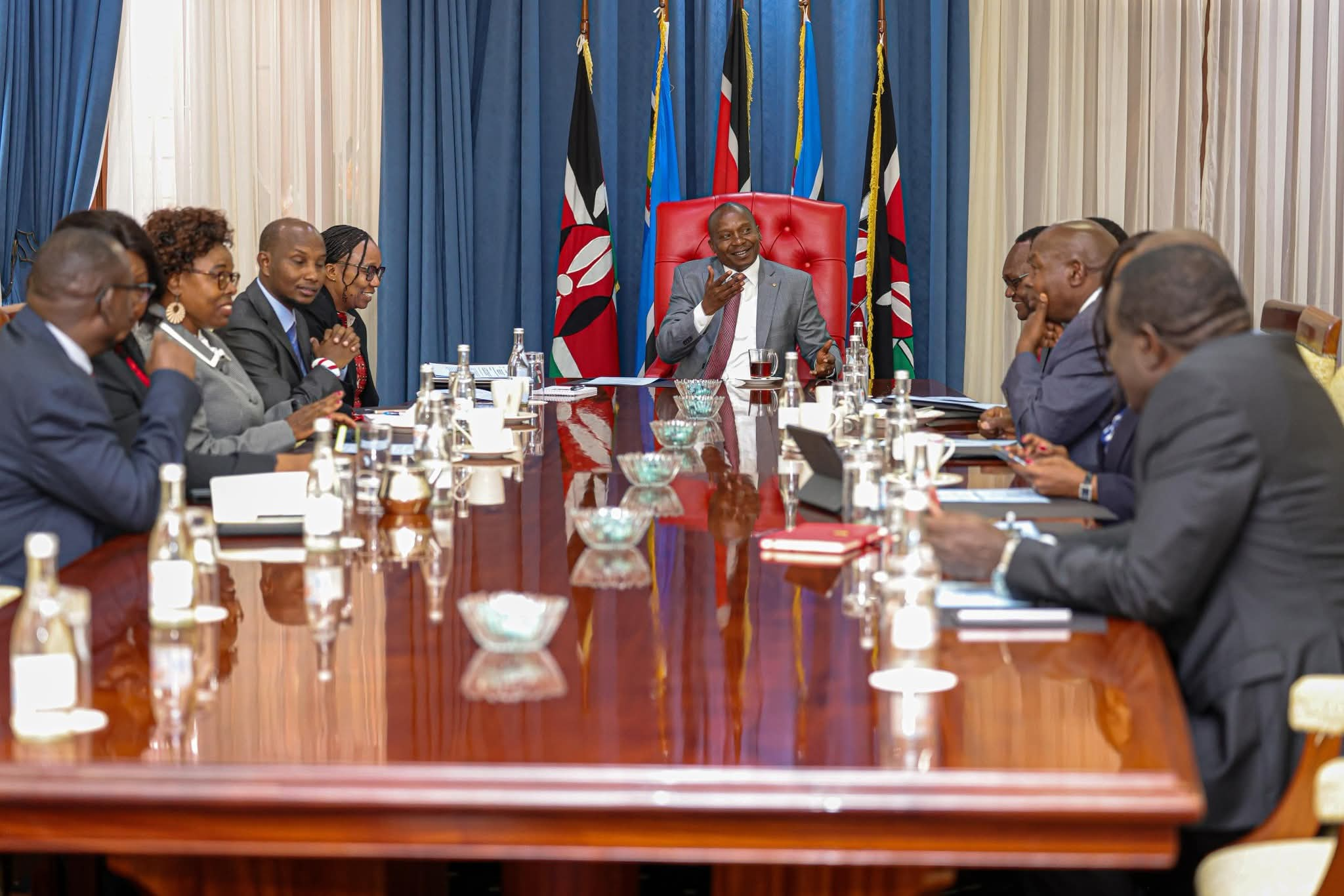

On Monday, the Intergovernmental Budget and Economic Council, chaired by Deputy President Kithure Kindiki, instructed finance executives to open accounts at the Central Bank of Kenya and appoint county assembly clerks as fund administrators.

More To Read

- Kindiki unveils Sh1 billion plan to power 6,100 Marsabit homes

- KMTC students to start accessing Helb loans after final talks next week

- Treasury CS John Mbadi defends ballooning State House budget

- Kenya adopts Women Entrepreneurs Finance Code to close gender financing gap for women entrepreneurs

- Activist moves to appeal ruling on judges’ recusal in Kindiki ouster case

- Chief Justice Koome calls for stronger East Africa judicial collaboration

This directive came amid growing concern that assemblies have yet to enjoy the benefits of the County Public Finance Laws (Amendment) Act, 2023, which was signed into law in August.

The law was introduced to give assemblies control over their finances by allowing them to manage their budgets independently from county executives.

It requires each county to set up a County Assembly Fund, managed by the clerk, to receive and retain all assembly monies. Any withdrawals must be approved by the Controller of Budget and authorised in writing by the administrator.

The National Treasury is also obligated to release funds directly into these accounts each month, not later than the 15th, to ensure smooth operations.

However, implementation has stalled as finance CECs are yet to open the required accounts, slowing down the entire process.

Previously, the Public Finance Management Act required executives to get assembly approval before setting up such funds. Under the amended law, this is no longer necessary, but county officials have yet to act.

County Assemblies Forum secretary general Mwaura Chege linked the delay to the procedure of opening accounts at the Central Bank.

“We wrote to the National Treasury on implementation, and they said they are preparing guidelines,” Mwaura said.

“The CECs must write to the Central Bank, indicating the names of authorised AIE (Authority to Incur Expenditure) holders. Once accounts are opened, assemblies can then align appropriations,” he added.

Senate Deputy Speaker Kathuri Murungi, who sponsored the legislation, said the continued lack of financial independence is undermining oversight in counties.

“Most of the time, assemblies requisition for funds but get nothing, making it impossible to carry out their work. Assemblies cannot be independent if they rely on governors for money,” Murungi said.

He compared the current situation to Parliament before it gained full control over its finances.

“Parliament decides how to allocate its money through the Parliamentary Service Commission. County assemblies deserve the same treatment,” he added.

Murungi warned that financial reliance has left assembly staff vulnerable to external influence and intimidation, weakening their ability to operate freely.

The County Governments Act provides that assemblies’ budgets should not be below seven per cent of county revenue or twice personnel emoluments, whichever is lower, a safeguard aimed at guaranteeing their financial stability.

But until the funds are operationalised, MCAs will continue to rely on county executives for resources, undermining the intent of the new law.

Top Stories Today