Ruto's affordable housing project faces new hurdle after fresh petition

By Barack Oduor |

In the matter filed as urgent, the petitioners have accused the state of violating the Constitution on the distribution of functions between the national and county governments, imposing a tax with a faulty legal framework.

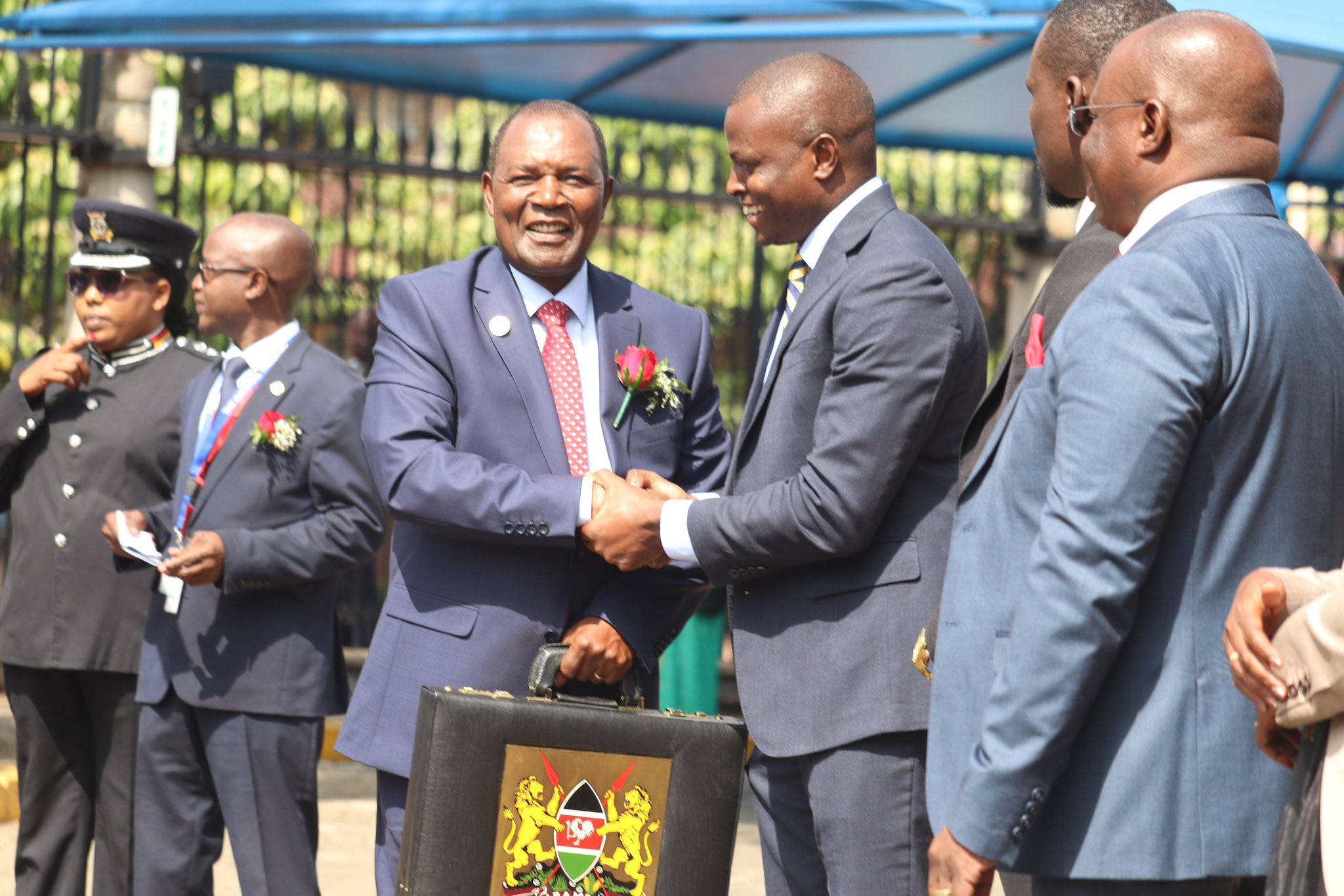

President William Ruto's affordable housing project faces a new hurdle barely a day after he signed the Affordable Housing Bill into law at State House, Nairobi.

Benjamin Magare, a Nakuru-based doctor, together with Pauline Kinyanjui, Philemon Nyakundi, Shallum Nyakundi and Jamlick Orina who identify themselves as Nakuru residents have moved to court to oppose the law on grounds that it attempts to introduce communist ideologies.

Keep reading

- Sh5.2 million diaspora-driven project set to revitalise Malindi's tourism sector

- Affordable housing boom: Fairdeal Properties unveils 600-unit development in Mombasa

- Affordable housing wins big in 2024/25 Budget with 916 per cent increase in allocation

- Only 15,000 flood-affected households yet to receive Sh10,000 compensation - Kindiki

The petition is the latest hurdle in Ruto's flagship project which has been dogged by a series of court cases.

"The Affordable Housing Act 2024, essentially tries to introduce communist ideologies yet, there is nowhere in the Constitution which allows the government to introduce communist ideologies. Kenya is not a communist state and the Constitution does not envisage it," the petitioners submit.

Communism is a socialist ideology which seeks to create a social order centred around common ownership of the means of production, distribution, and exchange that allocates products to everyone in the society based on need.

The petitioners in their suit argue that the national government has now taken over the housing function from county governments and that the new law has introduced "a shadowy entity, the 'collector' which collects funds," instead of the Kenya Revenue Authority.

Lands Cabinet Secretary Alice Wahome, her Treasury counterpart Njuguna Ndung'u, Attorney-General Justin Muturi, the National Assembly and the Senate are listed as respondents in the suit.

Violating Constitution

In the matter filed as urgent, they have accused the state of violating the Constitution on the distribution of functions between the national and county governments, imposing a tax with a faulty legal framework and blatant dismissal of the results of the public participation process.

"The Affordable Housing Act has proceeded to impose a levy which was rejected by the majority during public participation hence rendering public participation a cosmetic procedure and a waste of public resources," read the court papers.

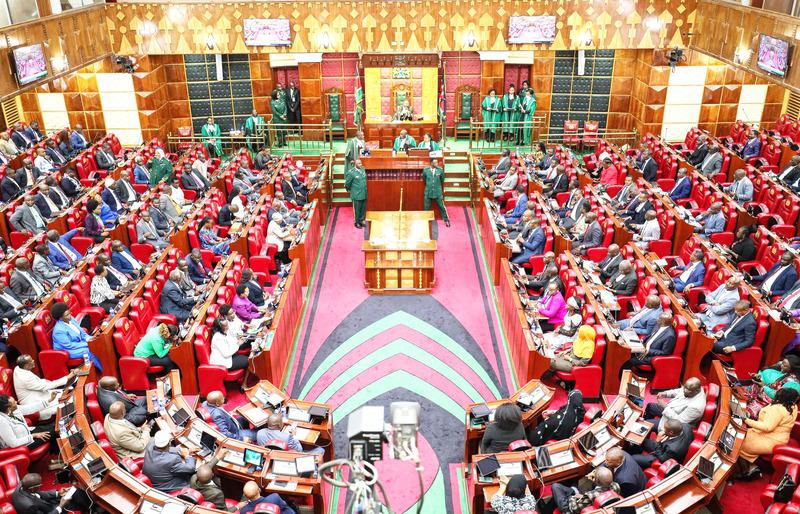

President William Ruto assents to the Affordable Housing Bill at State House, Nairobi on March 19, 2024.(Photo: PCS)

President William Ruto assents to the Affordable Housing Bill at State House, Nairobi on March 19, 2024.(Photo: PCS)

They also claim the Housing Fund has been created with a wrong legal framework and structures for implementation, making its application a matter for the executive's decision, therefore, making it susceptible to abuse.

They also aver that there are no guarantees to contributors of benefits and that "there are very low penalties for stealing from the fund/board."

"For all practical purposes, the fund subjects employees and other income earners to cruel, inhuman and degrading treatment, which is tantamount to servitude," the suit reads.

"Discriminatory"

The petitioners also put it that the new housing law is discriminatory because it outlaws corporations from owning a house under the affordable housing programme yet they pay taxes and contribute to the economy.

They also explain in their petition that an individual's salary is their private property and that the tax is unreasonable and unconstitutional because "it amounts to condemning workers to service mortgages for unknown houses they don't need and will never own."

"Some of the employees already own houses or are servicing mortgages, or they stay in staff houses provided by their employers, or they earn housing allowances paid by their employers," the petition reads.

They have asked the court to immediately stop the commencement, levying, obligations and operationalisation of the Affordable Housing Act while the government is stopped from evicting any person from public land for purposes of the act.

The new law provides for the affordable housing levy at the rate of 1.5 per cent of the gross income of a business or an individual and a matching contribution of the same amount in the case of employers.

The 1.5 per cent tax from both the employer and the employee will take effect at the end of the month.

It also provides for a double taxation check, by exempting persons who pay the matching contribution from paying the levy on their gross pay.

It further provides for affordable housing relief at 15 per cent for employees who make contributions to the Levy. Other tax-related incentives relate to the reduction of the turnover tax from 3 per cent to 1.5 per cent, to alleviate the tax burden for the informal sector.