CBK survey shows more Kenyans saving with NSSF to secure future in retirement

By Maureen Kinyanjui |

This growth is attributed to the full implementation of the NSSF Act, which was previously delayed due to a court injunction.This growth is attributed to the full implementation of the NSSF Act, which was previously delayed due to a court injunction.

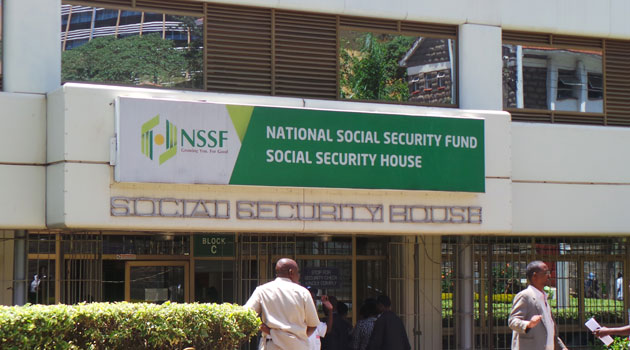

Recent data has revealed a significant shift in how Kenyans are preparing for their retirement, with an increasing number now relying on the National Social Security Fund (NSSF) to secure their future.

Since the government began implementing the NSSF Act of 2013, the public pension fund has seen steady growth, while traditional occupational retirement schemes have stagnated.

Keep reading

According to the 2024 Central Bank's Finances Household Survey, the percentage of Kenyans saving for retirement through NSSF rose to 11.4 per cent this year, up from 9.5 per cent in 2021.

This growth is attributed to the full implementation of the NSSF Act, which was previously delayed due to a court injunction.

The law mandates that employers contribute to the pension fund for their employees, significantly enhancing compliance.

"A majority of the adult population saving for retirement were doing so through NSSF at 11.4 per cent, which remains the dominant pension product," the survey reported.

It also noted that the increase in NSSF participation was largely due to the lifting of the court injunction in 2022, which allowed the law to be fully enforced.

The positive trend in NSSF savings is further supported by figures showing that NSSF collections have surged.

In the year leading up to June 2023, NSSF's collections rose by Sh10.9 billion to Sh26.8 billion.

New NSSF law

This increase follows the implementation of the new NSSF law, which raised mandatory pension contributions.

The changes saw the minimum contribution rise from Sh200 to Sh360 for low-earning workers, with the government gradually increasing contributions in phases.

By the fifth year of the law's implementation, workers will contribute 6 per cent of their salaries, with employers matching the amount.

Despite the growth in NSSF savings, occupational retirement benefit schemes have not seen similar success.

The survey found that participation in these private schemes remained flat at 1.5 per cent of the population over the same period.

A notable trend has been that many employers with private retirement plans have reduced their contributions in favour of the NSSF, possibly stunting the growth of these occupational schemes.

The data also suggests that while NSSF remains the dominant savings option, its rise could be contributing to the stagnation of other retirement savings avenues.

As more workers are brought into the NSSF fold, employers are gradually reducing their investments in private retirement schemes, which may be limiting the expansion of these alternatives.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!