Uganda to cut spending, domestic borrowing in 2025/26, finance ministry says

The government says borrowing has been used to drive economic growth, which has been faster than many of its African peers since the COVID-19 pandemic.

Uganda's government plans to cut spending by just over a fifth and domestic borrowing by just over a half in the 2025/26 (July-June) fiscal year, the finance ministry said on Friday.

Uganda's rising public debt load has been fuelling concerns among oppositions politicians and also triggered ratings agencies Fitch and Moody's to cut the country's credit rating.

More To Read

- Kenya’s exports to EAC partners grow as diaspora sends Sh1 trillion home

- Uhuru played key role in securing release of activists Njagi and Oyoo – Irungu Houghton

- Bob Njagi and Nicholas Oyoo reveal they were held, tortured by Ugandan military

- Uganda frees activists Bob Njagi and Nicholas Oyoo after diplomatic talks

- Kampala High Court rejects Kizza Besigye’s bid to refer treason case to constitutional court

- Activists petition Parliament to summon PS Sing’Oei over abducted Kenyans in Uganda

The government says borrowing has been used to drive economic growth, which has been faster than many of its African peers since the COVID-19 pandemic.

Overall government spending for 2025/26 is projected at 57.4 trillion Ugandan shillings ($15.56 billion), compared with 72.1 trillion shillings planned for the present financial year, a draft budget paper from the ministry showed.

The government plans to borrow about 4.01 trillion shillings ($1.09 billion) from the domestic market via Treasury bonds in the same period, 53.9% lower than in 2024/25, it said.

The ministry gave no reason for the drop in spending or borrowing figures.

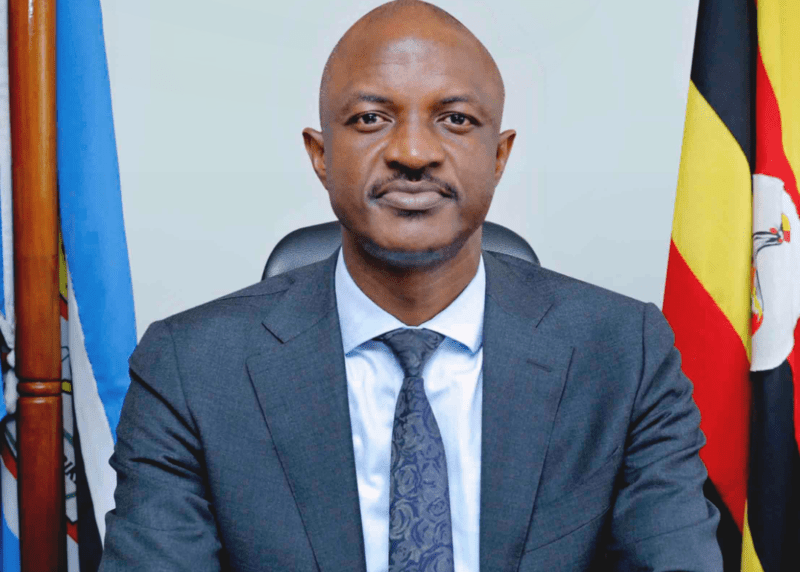

Ramathan Ggoobi, the Finance Ministry's permanent secretary, said the government's funding priorities would be in agro-industrialisation, tourism, and minerals including petroleum.

Ggoobi said external debt repayments are expected to rise to 4.03 trillion shillings in 2025/26 from 3.1 trillion shillings in the present fiscal year, adding to the squeeze in domestic spending.

Top Stories Today