State urges Kenyans to collect Sh63 billion in unclaimed assets

Kenyans have been urged to expedite the claims process by using the provided channels.

The Unclaimed Financial Assets Authority has called upon citizens to collect their money held at the Central Bank of Kenya.

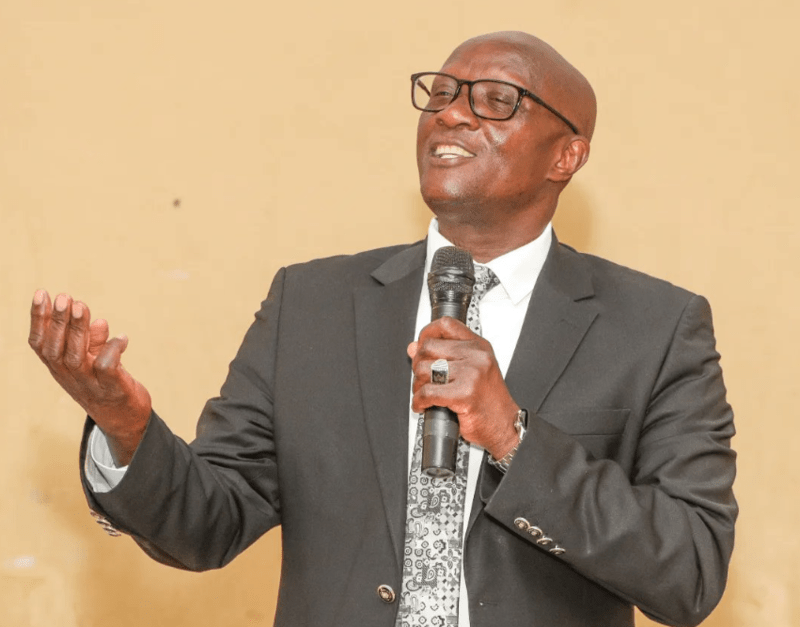

UFAA Chairperson Francis Njenga and his team have been guiding Kenyans in various regions on how to check if they're listed by UFAA_Ke and confirming the status of any assets registered under their names.

More To Read

- President Ruto pitches National Infrastructure Fund as engine for long‑term growth

- World Bank warns political interference weakening Kenya’s state-owned enterprises

- Women secure majority of contracts in inclusive government procurement programme

- Treasury CS John Mbadi defends ballooning State House budget

- Government, miners form joint committees to curb exploitation, protect communities

- Treasury’s plan to abolish six development authorities raises fears over 423 projects, 1,500 jobs

“We have a total of Sh63 billion unclaimed; out of that, Sh33 billion is in cash and 1.7 billion is in shares worth Sh30 billion,” revealed Njenga.

He was speaking in Embu on Monday when the Authority sensitized officers of the National Government Administration on ways that members of the public can access the assets.

The authority has successfully conducted similar events in Thika, Kisumu, Nyeri, Kirinyaga, Nakuru, and Murang’a and urged Kenyans to retrieve their funds.

Njenga highlighted the authority's commitment to distributing unclaimed assets.

"Since we began this programme to reach out to Kenyans with unclaimed assets, we have paid over Sh2 billion in assets, and by the end of the year, we want to have paid out Sh10 billion."

Provided channels

Njenga urged citizens to expedite the claims process by using the provided channels.

"Claims take 7 to 14 days to be processed, and Kenyans can file their claims by dialling *361# or by visiting the UFAA website."

Furthermore, Njenga emphasised plans to enhance service availability and accessibility at lower levels, collaborating closely with existing Huduma Kenya Service Delivery infrastructures.

He also issued a stern warning to financial institutions, asserting that those holding unclaimed assets for two to five years must forward the details to the UFAA.

Failure to comply with Kenyan law could result in the culpable institution paying double the amount.

Unclaimed financial assets, as defined by the UFAA, encompass abandoned assets presumed under the provisions of sections 4 to 18 of the UFA Act. This includes items transferred to the authority as well as those deemed unclaimed under other laws.

The Authority covers all income, dividends, or interest associated with these assets, excluding any lawful charges.

UFAA is a state corporation established under the National Treasury pursuant to the Unclaimed Financial Assets Act. No. 40 of 2011.

The primary mandate of the Authority is to receive unclaimed financial assets from holders of such assets, safeguard these unclaimed assets, and re-unite the assets with their rightful owners.

Top Stories Today