Safaricom enables direct PayPal withdrawals via M-Pesa app for Kenyan users

The move is aimed at supporting Kenya’s fast-growing community of freelancers, remote workers, and digital entrepreneurs, many of whom depend on PayPal for international payments.

Safaricom has rolled out a new feature allowing users to withdraw funds from PayPal directly through the M‑Pesa app, marking a major step forward in convenience and integration.

The move is aimed at supporting Kenya’s fast-growing community of freelancers, remote workers, and digital entrepreneurs, many of whom depend on PayPal for international payments.

More To Read

- Kenya’s 5G users hit 1.5 million as adoption accelerates

- Kenyans invited to give views on proposed partial sale of government’s Safaricom stake

- Ndindi Nyoro questions government’s decision to sell 15 per cent Safaricom stake

- Safaricom rolls out Daraja 3.0 in major M-Pesa API redesign

- Safaricom announces early-morning Fuliza system upgrade on November 17

- Kenya eyes wider telecom connectivity in next decade

Previously, users had to navigate web portals, use third-party brokers, or log in multiple times to complete withdrawals. With this update, the process is streamlined—PayPal funds can now be transferred straight to M‑Pesa with just a few taps on a smartphone.

Safaricom reports that the M‑Pesa app has been downloaded 13.7 million times, with 4.7 million active users. Wallet limits now stand at Sh500,000 (about $3,875), with per-transaction caps of Sh250,000 ($1,938), and a daily maximum of Sh500,000.

By embedding PayPal directly into its platform, Safaricom is offering a smoother, faster alternative to traditional withdrawal methods like Equity Bank’s PayPal service, which relies on interbank transfers.

This positions M‑Pesa as a key tool for the digital economy, empowering small businesses and individual users alike.

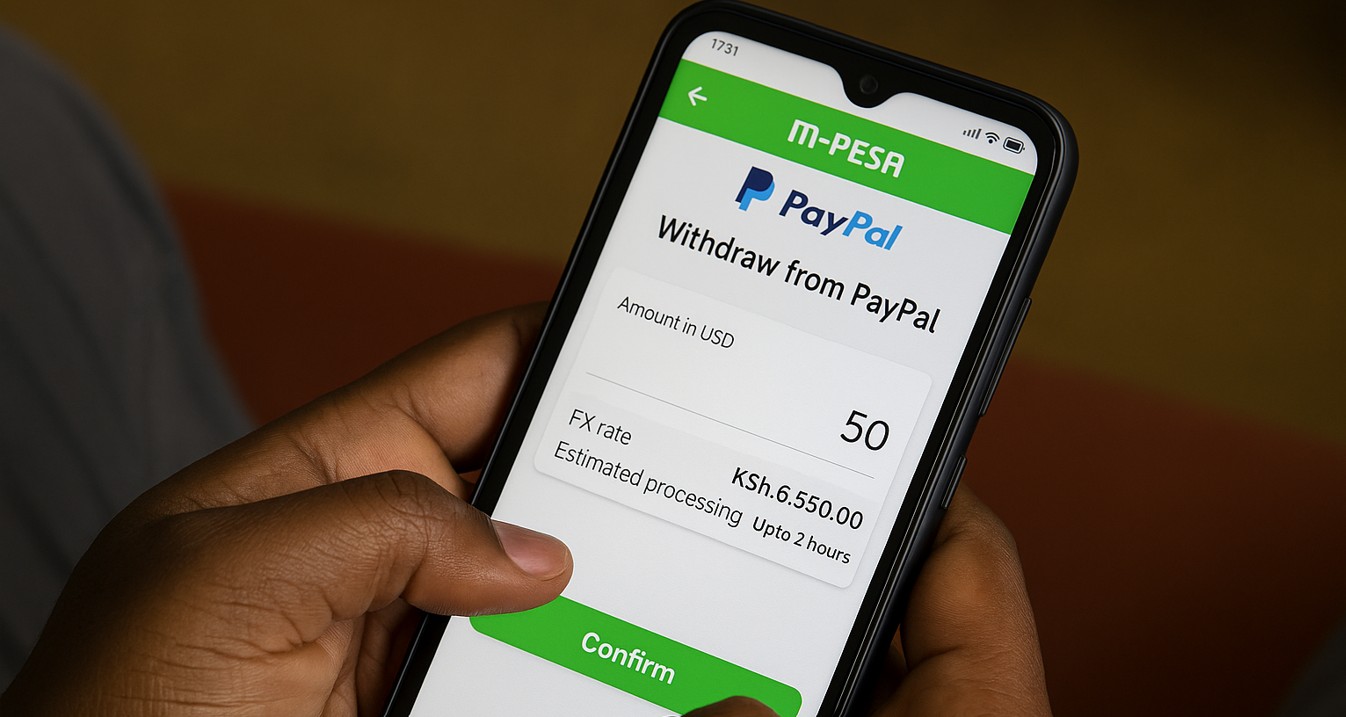

How to Withdraw from PayPal Using the M‑Pesa app (Android only)

• Install or update the latest M‑Pesa super app on your Android device.

• Scroll down to the Global Payments section and tap the PayPal logo. Log in and link your PayPal account.

• Choose to withdraw or deposit, then enter the amount in USD.

• View the equivalent in Kenyan shillings, along with the exchange rate and estimated processing time.

• Confirm the transfer.

Your funds will be credited to your M‑Pesa wallet within 2 hours to 3 days, depending on the transaction size.

This mobile-first solution eliminates the need for bank intermediaries or third-party platforms. It’s faster, safer, and designed to meet the needs of modern users who want full financial control from their phones.

Top Stories Today