Treasury under scrutiny over missing records for Sh161 Billion debt payments

Senators have questioned the National Treasury about Sh161 billion in debt repayments that span three financial years—2021, 2022, and 2023—and are demanding a detailed explanation for the unaccounted payments.

The move follows a special audit report by Auditor-General Nancy Gathungu, which revealed that the Treasury failed to provide adequate supporting documentation for debt servicing during this period.

More To Read

- Rival Isiolo speakers face Senate over audit failures

- World Bank warns political interference weakening Kenya’s state-owned enterprises

- Women secure majority of contracts in inclusive government procurement programme

- MPs back move to amend finance law to align audit timelines with Constitution

- Treasury CS John Mbadi defends ballooning State House budget

- Senate begins two-day plenary impeachment trial for Nyamira governor Nyaribo

The revelations have triggered an inquiry by the Senate Finance and Budget Committee, chaired by Mandera Senator Ali Roba. The committee's task includes uncovering the reasons behind the missing documentation and providing a broader analysis of Kenya's public debt.

The Senate's inquiry is not just about the Sh161 billion but also aims to examine the country's borrowing trends over the past decade.

The committee is expected to distinguish between domestic and external debt, outline repayment timelines, and assess the measures in place to mitigate default risks.

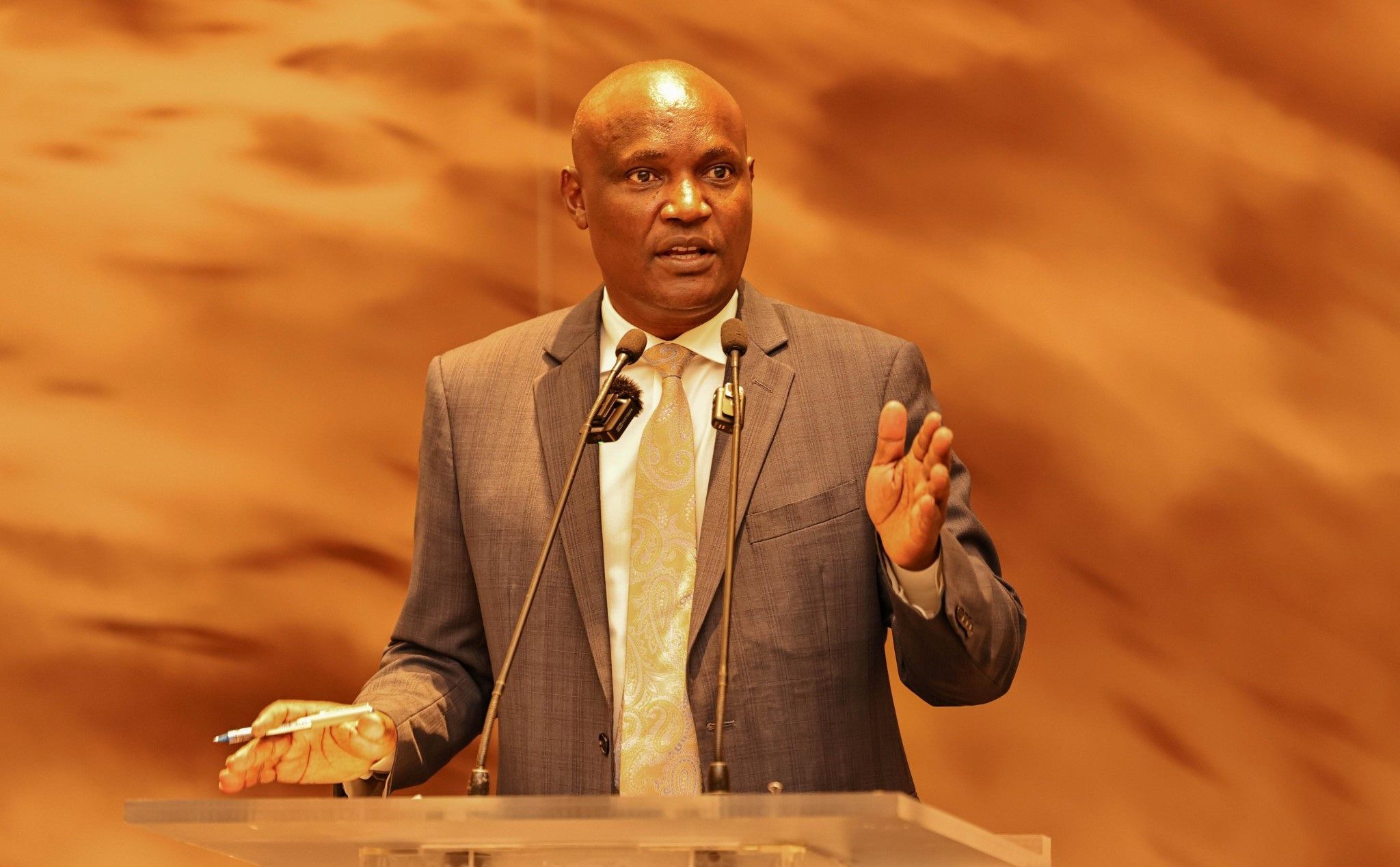

“The Auditor-General’s findings raise serious concerns about possible budgeted corruption and the misuse of public resources,” said Kisii Senator Richard Onyonka.

“This inquiry should evaluate the prudence of government borrowing, the sustainability of Kenya’s public debt, and the broader accountability gaps in our financial management systems.”

Senator Onyonka also urged the committee to explore legal and policy reforms to improve transparency in borrowing and repayment processes. “Restoring public trust and ensuring fiscal sustainability must be at the core of these investigations,” he added.

Court ruling

The demand for accountability extends beyond parliamentary committees. High Court Judge Lawrence Mugambi recently issued a landmark ruling, directing the government to disclose within 45 days the utilisation of funds raised through sovereign bonds in the last nine years.

The directive came after the Kenya Human Rights Commission (KHRC) and activist Wanjiru Gikonyo filed a case against the Treasury for withholding information on sovereign bond agreements.

The court dismissed the Treasury’s argument that such information was already available in budget policy statements, ruling that these documents only outline borrowing proposals rather than detailing actual expenditures.

“The public has a right to know how their government conducts its financial affairs to make informed decisions,” said the KHRC in a statement.

The Treasury has also disclosed that Kenya plans to re-enter international capital markets with a new Eurobond in 2026. Kenya’s stock of outstanding Eurobonds currently stands at Sh854.8 billion, with repayments scheduled as far out as 2048. The next major repayment, Sh116.3 billion, is due in May 2027.

Senators have expressed alarm over the government’s plans to borrow an additional Sh413 billion in the 2024 and 2025 financial years, questioning the sustainability of such borrowing amid glaring accountability issues.

“Kenya’s debt situation demands urgent action. The committee must scrutinise the government’s borrowing practices and ensure there are robust measures to prevent waste and misuse of public funds,” said Senator Onyonka.

Top Stories Today