Kenya’s tax system narrows inequality but pushes more people into poverty - report

KIPPRA says direct and indirect taxes are eroding household incomes faster than government transfers can replenish them.

Kenya’s fiscal system is failing the poor, even as it quietly polishes its credentials on inequality, a new report has shown.

Dubbed the ‘Fiscal Incidence Analysis Report’ by state-owned research firm, Kenya Institute for Public Policy Research and Analysis (KIPPRA), it notes that although the country’s fiscal space may slightly narrow income gaps, they are actively pushing more Kenyans into poverty.

More To Read

- Ruto: Under my reign the cost of living, inflation has gone down

- New KIPPRA report exposes the hidden weaknesses crippling Kenya’s forest industry

- Investing in rural roads key to doubling Kenya’s farm output - study

- Foreign Investments offer minimal impact to Kenya’s industrialisation, study shows

- Why Kenyan SMEs struggle to break into export market despite government push

- Export weakness, key obstacle to Kenya’s path to middle-income status - report

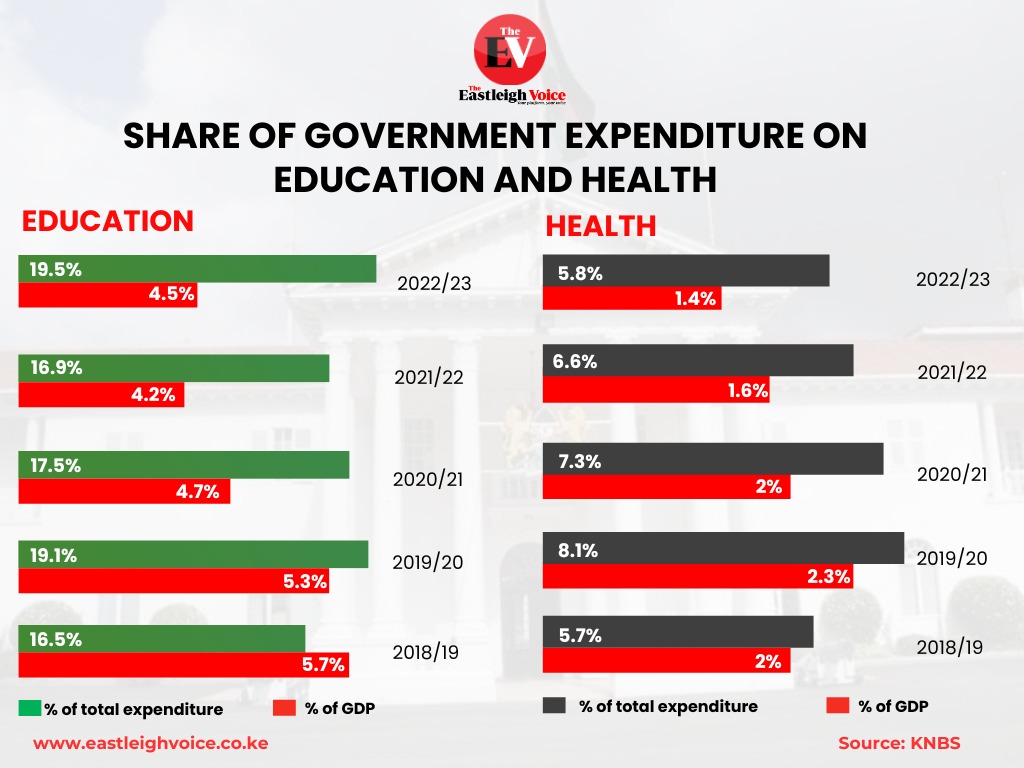

In 2022, the latest review year for the study, Kenya’s tax-and-spend framework reduced inequality by 4.6 Gini points, largely through public spending on health and education.

This redistribution, however, masks a harsher reality.

“Kenya’s fiscal system reduces inequality but has limited, and even adverse, impact on poverty,” the report reads.

In other words, the system looks fairer on paper while households struggle more in practice.

The problem lies in the weight of taxation.

KIPPRA says direct and indirect taxes are eroding household incomes faster than government transfers can replenish them.

As a result, fiscal policy increased poverty by 2.7 percentage points nationwide during the review year, underscoring a system that gives with one hand and takes more with the other.

Urban households are bearing the brunt of this imbalance.

While rural and ASAL regions start off poorer, the report shows that the poverty-increasing effects of taxes are more severe in urban and non-ASAL counties.

These households contribute more through consumption taxes and social insurance, yet receive proportionately less support, turning cities into fiscal pressure points.

Compared with peer countries, Kenya is underperforming.

The inequality reduction achieved through fiscal policy is lower than in most comparator economies, suggesting missed opportunities for progressive reform.

More concerning, Kenya stands out for increasing poverty through fiscal measures, while many countries manage to reduce both inequality and poverty simultaneously.

Gender dynamics further expose the system’s shortcomings.

Although fiscal policy narrows income gaps between male- and female-headed households, poverty in the country remains higher among female-headed households and those where women are the main income earners.

Nevertheless, the failure is clearer in child welfare.

A significant proportion of children, approximately one in three, experience poverty in both monetary terms and across multiple dimensions of well-being, with nearly a third of monetarily poor children facing three or more deprivations simultaneously.

“The current fiscal system of taxes and transfers in Kenya has the unintended consequence of increasing child poverty, raising it from 41.8 per cent to 44.7 per cent,” reads the report.

“However, it does contribute to reducing child inequality by 5 Gini points, indicating a positive redistributive effect.”

Top Stories Today